Farmingdale, New York Dec 30, 2020 (Issuewire.com) - Why is the 1099-NEC Replacing Form 1099-MISC (Box 7)?

The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) -- enacted on December 18, 2015 – created a unique situation for tax filers. In addition to moving the due date for Form 1099-MISC Forms containing data in Box 7; (nonemployee compensation), from February 28 to January 31, the legislation eliminated the automatic 30-day filing extension. If an employer filed a batch of multiple 1099-MISC forms (potentially with data in Box 7 (nonemployee compensation) and without) after the January 31st deadline, the IRS could mistakenly treat them all as of late returns and apply fines. Beyond the time-management and administrative issues for the IRS to properly process the forms, some misaligned deadlines on the taxpayer side opened the door to fraud. To resolve the various issues, the IRS revived Form 1099-NEC, effectively separating Box 7 (nonemployee compensation) from the 1099-MISC, as well as staggering the filing due dates.

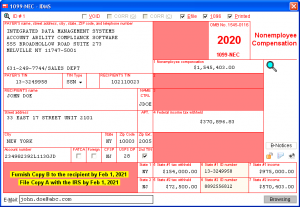

The 2020 version of Account Ability Tax Form Preparation Software includes full support for Form 1099-NEC User Interface as well as Form 1099-MISC User Interface. Account Ability complies with IRS specifications for the entire family of information returns and annual wage reports.

Media Contact

IDMS Account Ability Sales@IDMSInc.com 800-582-5831 555 Broadhollow Rd https://www.idmsinc.com