Jakarta, Indonesia Oct 31, 2025 (Issuewire.com) - A new study by behavioral analytics and sentiment intelligence firm Quantxora delivers a sharp wake-up call to the crypto trading world: the real reason most traders lose money isn't bad data, it's poor focus.

In a market saturated with charts, alerts, and influencers all screaming for attention, Quantxora's findings expose a fundamental truth: the crypto market isn't just volatile, it's mentally deafening. Retail traders aren't simply fighting price swings; they're fighting a constant barrage of distraction.

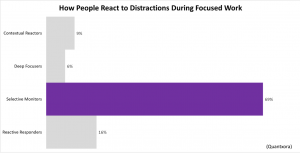

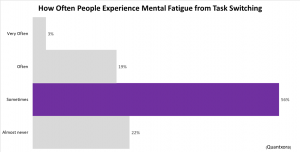

The firm's behavioral analysis revealed that the habit of relentless checking and task-switching is rampant. A staggering 69% of people glance at notifications during focused work, and 56% report mental fatigue from switching between tasks. While the broader survey didn't focus solely on crypto, the results perfectly mirror the high-stakes, always-on attention habits of traders in a 24/7 market.

"Attention is Alpha": The Cognitive Advantage

“Retail traders don’t need more data what they need is a better filter for the market,” said a Quantxora spokesperson. “Everyone’s chasing the next signal on a chart, but the real signal is inside the mind. Attention is alpha.”

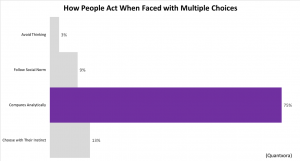

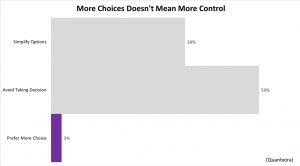

Quantxora introduces the concept of “Cognitive Alpha,” reframing trading success as a function of mental clarity, not just technical prowess. The firm argues that while institutions optimize for speed and algorithms, retail traders are desperate for simplicity. Their edge comes down to one thing: the ability to focus, make deliberate choices, and act confidently without drowning in informational chaos.

The study pinpointed three major psychological traps that lead to poor outcomes:

-

Impulse Vigilance: Mistaking constant price-checking and screen refreshing for control, when it’s actually just an emotional reaction.

-

Decision Fatigue: Overanalyzing every potential trade until rational thought collapses into a high-risk impulse.

-

Choice Overload: With over 20,000 tokens available, traders get stuck in endless comparison instead of making confident decisions.

Designing for Silence

Quantxora suggests this widespread problem isn't a failure of intelligence, but a failure of design with most trading tools and the market structure itself are built to maximize noise.

The solution, the firm asserts, is to educate traders to think like cognitive investors, developing calm, focused systems instead of chasing chaotic reaction feeds.

“The next generation of traders won’t win by knowing everything,” the report concludes. “They’ll win by filtering ruthlessly. In a noisy world, the real edge belongs to those who design for silence.”

Media Contact

Quantxora *****@quantxora.com http://quantxora.com