Singapore, Singapore Jul 6, 2024 (Issuewire.com) - We are delighted to announce that XDC Trade Network platform has successfully completed a pre shipment financing transaction against an electronic promissory note. The electronic promissory note (ePN) was issued using the Credore platform, which leverages the TradeTrust utility and is complying to the MLETR requirements. For issuing ePN data standards from ICC, DSI and framework from DLPC Business Best Practices by BAFT was used. This unique milestone marks the beginning of a significant stride in leveraging technology, framework, Legal Entity Identifier by GLIEF to enhance digital transactions in cross-border trade and financing them.

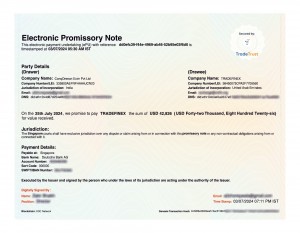

Transaction Details:

- Drawer: Conqoreeon Exim Private Limited

- Drawee: TradeFinex

- Trade Financing Platform: XDC Trade Network

- Documentation Platform: Credore (TradeTrust utility on XDC Network)

- Blockchain: XDC Network

- Promissory Note Format: ICC, DSI and DLPC by BAFT

- Purpose: Pre-shipment financing

- Amount: USD 42,500

- Legal Entity Identifier (LEI): Both stakeholders used validated LEIs in the document

- Governing Jurisdiction: Singapore courts have exclusive jurisdiction over any disputes or claims arising from or in connection with this promissory note.

Significance

This electronic promissory note transaction signifies a major advancement in trade finance, reducing processing times and increasing security through standardised digital negotiable instruments. The use of LEIs ensures the authenticity and verification of the involved entities, promoting transparency and trust in the digital transaction. The solution creates a Digital Identity with a public key that can be linked with any digital document, making it easier for a liquidity provider to verify the ID of the transacting parties from having to conduct their due diligence.

Efficiency Gains

Traditionally, a physical paper-based promissory note would take 3 to 5 days from instrument preparation to sending to the drawee (India to UAE) and a few more days to obtain the required Trade finance. The electronic promissory note was created, and transferred to the drawee within a few minutes, demonstrating the efficiency and speed of digital documentation. Faster settlement was also achieved which is very important for such short shipments and gives an advantage to the shipper as this enables them to securely share their data and obtain Trade Finance at much lower financing terms.

Pre-shipment finance is typically known for high KYC high execution costs and complex structures making it longer to execute. With our digital solution, we can lower the execution cost and disperse funds within 24 hours.

About XDC Trade Network (XTN)

XDC Trade Network is a complete suite of dApps on XDC Network that aims to redefine the global trade finance Industry. The objective of XTN is to provide liquidity for trade documents when presented in digital form. Exporters can avail of 100% funding by using electronic trade documents. XTN acts as a marketplace where borrowers and Liquidity providers (LP) are on-boarded through a regulated custodian. LPs can verify, endorse, and transfer title documents during the lending process by accessing TradeTrust and other trade registries. For more on the company and joining pilots please visit https://www.xdctrade.network/

About Credore

Credore - registered in India with multiple offices, offers a paperless IT infrastructure for MLETR-compliant electronic trade documents, ensuring legal admissibility and enhancing cross-border trade efficiency and document authenticity. Credore uses TradeTrust utility on XDC Network to create electronic trade documents. For more on Credore please visit https://www.credore.xyz/

Media Contact

Sunil Senapati sunil@xdctrade.network