Fort Myers, Florida Oct 8, 2018 (Issuewire.com) - Whistleblower sues IRS for 2.7 Trillion Dollars for not collecting taxes on kickbacks paid to healthcare insurance companies

IRS Whistleblower filed Tax Court case Docket No. 16585 – 18W for damages of 2.7 trillion dollars. The IRS refuses to enforce the tax law covering illegal kickbacks in the healthcare industry. The payment is a cancellation of debt owed by the insurance companies to the providers. The kickback is the difference of the billed amount on the patient's invoice and the actual amount paid by the insurance company. The providers and the insurance companies are on the accrual method of accounting; therefore, when the patient's bill is issued with the standard amounts charged to all patients, it is the amount recognized for tax purposes. The question facing the nation is whether the Department of Justice will defend the IRS for violating the tax laws or prosecute the decision makers in the Internal Revenue Service.

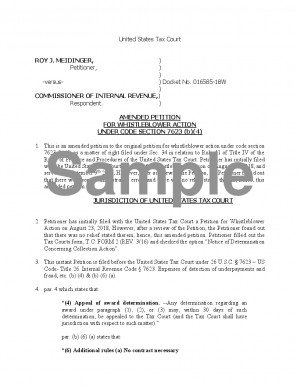

See attached case for legal issues and support documents.

Roy J Meidinger

14893 American Eagle Ct.

Fort Myers, Fl. 33912

Tel No. 954-790-9407

Email RoyJMeidinger@comcast.net

Media Contact

Saving the World RoyJMeidinger@comcast.net 954-790-9407 14893 American Eagle Ct.